Remodeling a home in San Diego can be both exciting and overwhelming. Perhaps you’re contemplating adding an extra room, giving your kitchen a modern makeover, or adapting your home for improved accessibility. Regardless of your plans, you might wonder if any of these costs are tax-deductible. While standard home remodels typically aren’t deductible in the same year you incur the expense, there are ways they can affect your taxes—especially when it comes time to sell your home.

At Kaminskiy Design and Remodeling, we’ve spent years helping homeowners bring their dream spaces to life. To help you navigate potential tax implications, we’ve compiled this guide covering common scenarios and tips you should know before, during, or after your remodel.

Note: This blog provides general tax guidance. Always consult a qualified tax professional for personalized advice.

Prefer Listening? Here’s the Podcast Version:

Thinking about a home remodel but worried about the cost? Some renovations could actually lower your tax bill! While not all projects qualify for deductions, certain upgrades—like energy-efficient improvements, medical necessity modifications, and home office renovations—may offer valuable tax benefits.

Understanding which remodels impact your taxes can help you make smarter financial decisions and even boost your home’s resale value. Keep reading to discover which renovations might save you money and how to maximize your investment!

What is a Capital Improvement?

A capital improvement is a project that significantly adds value to your home, prolongs its useful life, or adapts it for a new use. Examples include:1

Why It Matters

Tip: Keep a dedicated folder (physical or digital) for receipts, invoices, and work orders related to your remodel. Clear documentation of these expenses is crucial for accurate cost-basis calculations later.

If you’re installing ramps, widening doorways, or making other accessibility updates for medical reasons, some or all of these costs might be deductible as medical expenses.2 However, there are a few key considerations:

Example: Installing a wheelchair ramp may qualify for a deduction, but adding an elevator that significantly raises property value may not.

Eligibility depends on IRS rules, so it’s best to consult a tax professional for the latest guidance.

More San Diego homeowners are working remotely or running businesses from home. If a portion of your remodel is strictly for a home office space that you use exclusively and regularly for business, you may be able to:

Important Note: The IRS has strict guidelines for home office deductions. The space must be used exclusively for business—and not double as a guest room or family entertainment area.

Be Cautious: Misusing the home office deduction is a common IRS audit trigger. Keep clear records of expenses and usage.

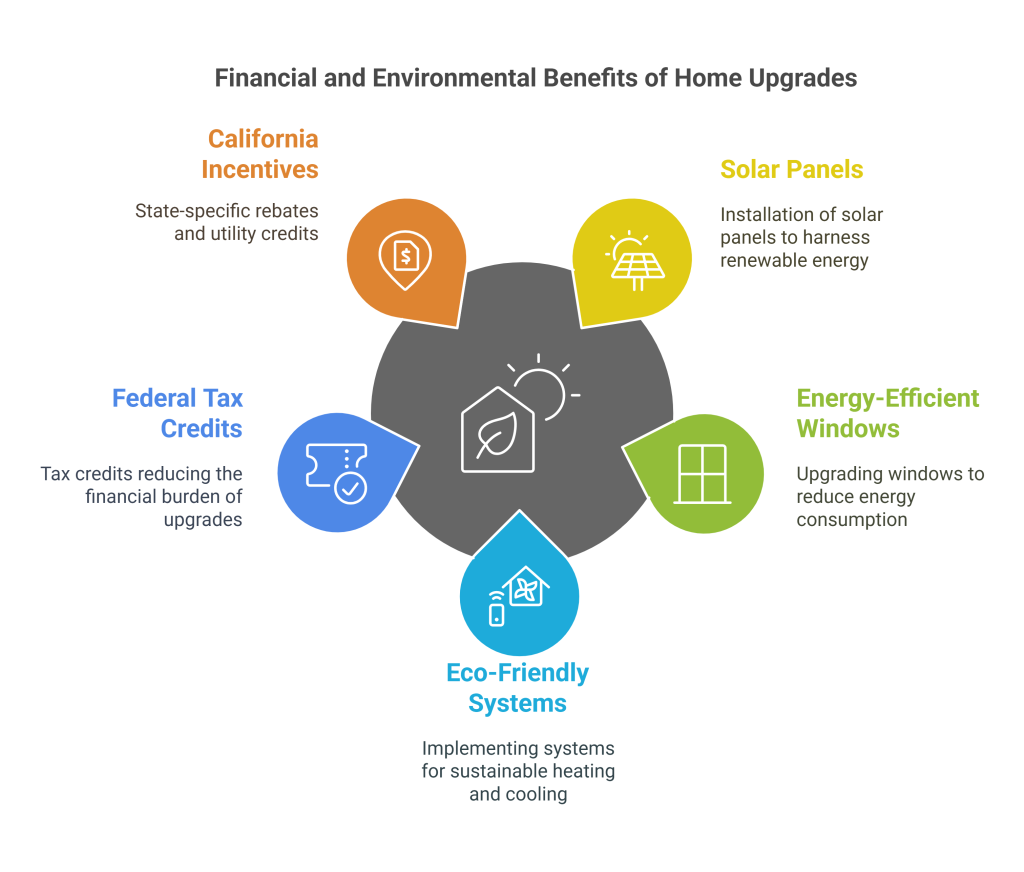

Suppose your remodeling project includes installing solar panels, energy-efficient windows, or upgrading to an eco-friendly heating and cooling system. In that case, you may qualify for federal tax credits (different from deductions). Credits reduce your tax bill dollar-for-dollar.3

California residents may also find additional incentives, rebates, or utility credits—making these upgrades both environmentally friendly and cost-efficient in the long run.4

California Incentives: Local rebates may be available—Check with San Diego Gas & Electric (SDG&E) or a local tax expert to see how much you can save.5

For those who own a rental property in San Diego, certain remodeling costs could be categorized as either repairs or capital improvements:

Tip: Proper classification is essential to maximize deductions and avoid penalties—a tax professional can help ensure accuracy.

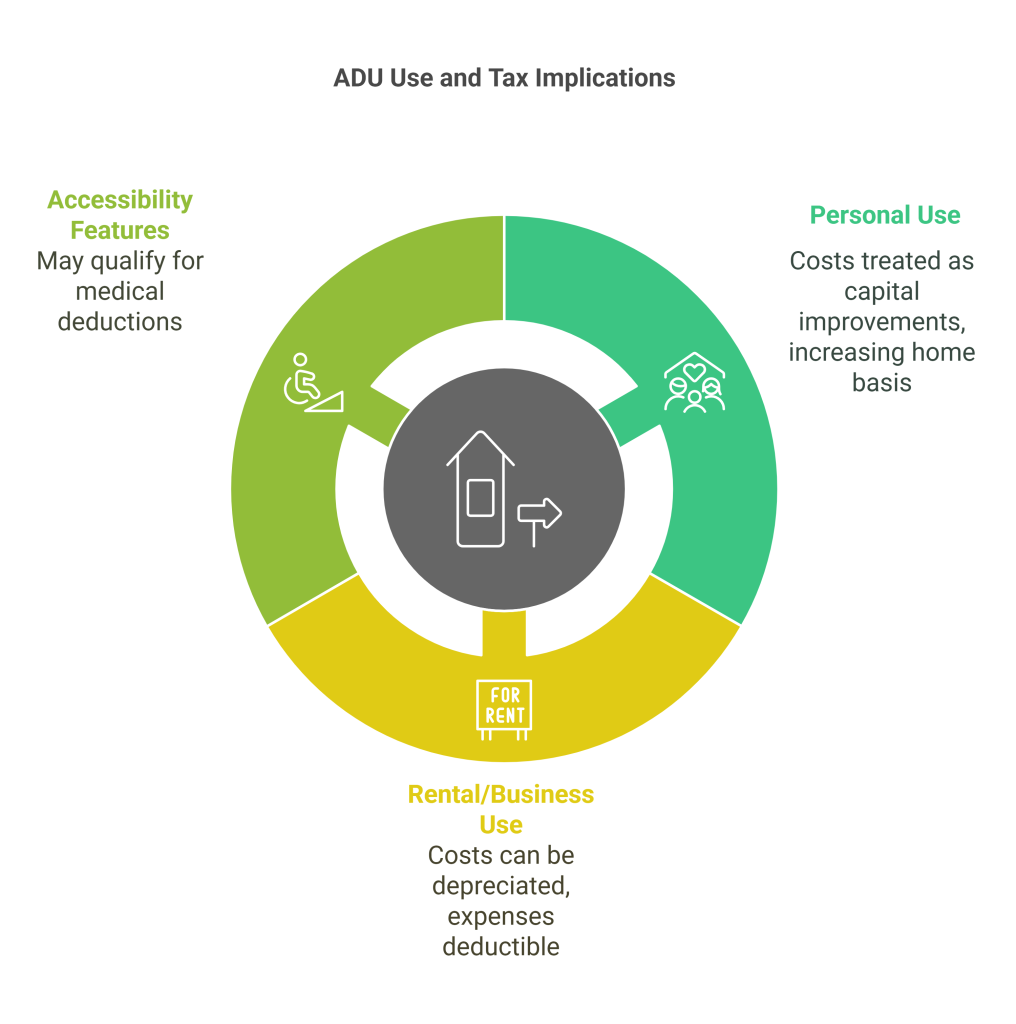

Accessory Dwelling Units (ADUs) are becoming increasingly popular in San Diego as a versatile solution for additional living space, rental income, or multigenerational living. When it comes to taxes, the deductibility of ADU-related expenses depends on how the unit is used:

Enhanced Accessibility Features:

Many San Diego homeowners opt to include custom accessibility updates in their ADU designs—such as bathrooms with mobility enhancements like grab bars, curbless showers, wheelchair-accessible sinks, specialized fixtures, or even mobility lifts and stair/elevator solutions. When these features are medically necessary, they might also qualify for deductions as part of medical necessity renovations.

Why It Matters:

Investing in a custom ADU not only adds value and flexibility to your property but can also offer tax benefits over time. Kaminskiy Design and Remodeling specializes in designing and building custom ADUs that integrate both functional living space and specialized accessibility features. Whether you’re looking to generate rental income, accommodate multigenerational living, or ensure your home is accessible for a loved one, our team is here to guide you through every step of the process.

Looking to build a custom ADU? Kaminskiy Design & Remodeling offers expert ADU designs with accessibility features that fit your needs.

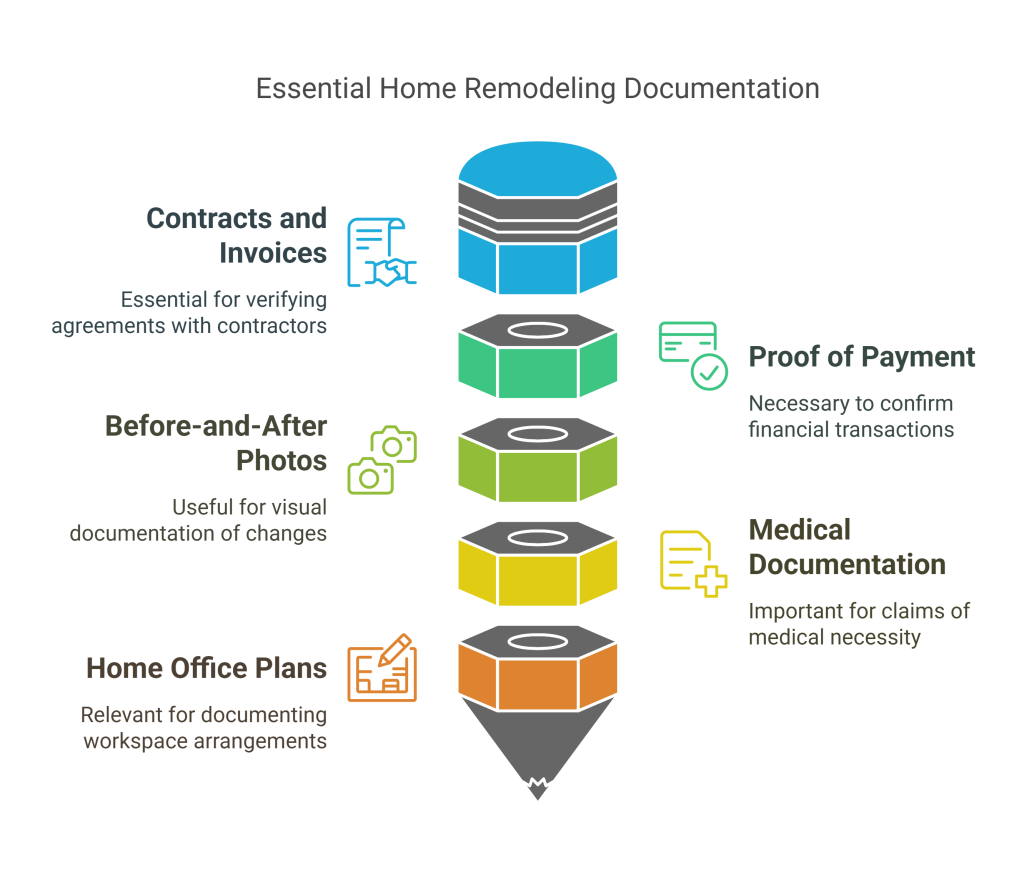

No matter which scenario applies to you, documentation is key. Create an organized system to store:

Having comprehensive records will make the tax reporting process more straightforward, whether during an IRS audit or simply calculating your adjusted cost basis when you sell your home.

Tip: Store records for at least seven years in case of IRS audits.

While the information here provides a helpful overview, it’s always best to consult with a licensed tax professional who can address your specific circumstances. Tax laws change regularly, and federal, state, and local rules may each have unique stipulations.

A San Diego-based tax advisor or CPA familiar with California’s regulations is your best resource to ensure you take advantage of any available benefits.

At Kaminskiy Design and Remodeling, we’ve guided countless San Diego homeowners through the remodeling process—from initial concepts to finishing touches. While we’re not tax experts, we do:

A home remodel is more than just a fresh coat of paint or a new layout—it’s an investment in your property’s long-term value and enjoyment. While many remodeling expenses aren’t immediately tax-deductible, certain improvements, especially those that qualify as capital improvements, medically necessary renovations, or energy-efficient upgrades, may offer tax advantages down the road.

If you’re thinking about a remodel or are already in the middle of one, Kaminskiy Design and Remodeling is here to guide you every step of the way. We believe in creating spaces that help you love where you live—even more so when financial benefits might be tied to your upgrades. For any tax-specific questions, remember to contact a local CPA or tax attorney who can tailor advice to your unique situation.

Disclaimer: This blog provides general information about potential tax considerations related to home remodeling and is not intended to serve as tax or legal advice. Tax laws can change, and individual circumstances vary. Always consult with a qualified tax professional for personalized guidance.

Most home renovations are not immediately tax-deductible, but certain improvements, like capital improvements, energy-efficient upgrades, and medical necessity renovations, may provide tax benefits in the long run, such as reducing capital gains taxes when you sell.

A capital improvement is a major upgrade that adds value, extends the home’s life, or adapts it for a new use. Examples include room additions, new roofs, HVAC systems, and major kitchen renovations. These expenses aren’t deductible upfront, but they increase your home’s cost basis, potentially lowering your capital gains tax when selling.

Yes, home office renovations may be deductible if the space is used exclusively and regularly for business. You may be able to deduct a percentage of remodeling costs, utilities, and maintenance based on the size of your home office compared to your total home size. However, the IRS has strict rules, so consult a tax professional.

Yes! Homeowners may be eligible for federal tax credits for installing solar panels (30% credit), energy-efficient windows (up to $600), heat pumps (up to $2,000), and insulation (up to $1,200). Additional California state incentives may also apply. Check with San Diego Gas & Electric (SDG&E) for local rebates.

It depends on how the ADU is used. If the ADU is for personal use, the cost is not deductible but increases the cost basis, which can lower capital gains tax when selling. If the ADU is used for rental or business purposes, you may be able to depreciate the ADU over time and deduct operating expenses.

Rental property owners can deduct repair costs (like fixing leaks or replacing a broken window) immediately. Larger upgrades, such as a new roof or plumbing system, must be depreciated over time. Proper tax classification is essential—consult a tax professional to ensure compliance.

Resources:

Kimberly Villa is a recognized expert in the Home Design and Remodeling industry. Her passion for the industry is matched only by her love for sharing insights, new trends, and design ideas. Kimberly’s expertise and enthusiasm shine through in her contributions to the Kaminskiy Design and Remodeling website blog, where she regularly shares valuable information with readers.