Last updated on January 2, 2024

California has recently enhanced the ADU Grant and Loan Programs to address the state’s critical need for affordable housing. It’s important to note that as of the latest update, the funds for Phase 2 have been fully allocated, but understanding the program remains crucial for future opportunities.

Accessory Dwelling Units (ADUs), commonly known as granny flats or in-law units, are an innovative solution in this effort. These programs are designed to assist homeowners, particularly those in low-income brackets (with income less than 80% of the Area Median Income), in financing the construction of ADUs on their properties, thus alleviating the housing crisis and providing additional income opportunities.

The California ADU Grant program, managed by CalHFA, offers up to $40,000 (Phase 2) towards predevelopment and non-recurring closing costs for ADU construction. Eligible expenses under this grant include site preparation, architectural designs, permits, soil tests, impact fees, property surveys, and energy reports. In line with recent legislative updates, CalHFA has implemented specific income limits and credit score requirements to ensure that assistance is directed toward needy households. Applicants must own and occupy the property as their primary residence, and the ADU must comply with Fannie Mae/FHA ADU feature requirements and meet all local zoning ordinances.

As part of its ongoing commitment, the state had allocated an additional $25 million (as per Resolution No. 23-13) towards financing ADUs in what is referred to as “Phase 2” of the program. While this funding has now been fully allocated, understanding the structure and benefits of Phase 2 can help prepare for any future phases or opportunities.

This one-time appropriation is part of a strategic move to bolster the program’s reach and effectiveness, particularly in socially disadvantaged areas. The Phase 2 program, which launched on December 11, 2023, has seen significant interest, and its funds have been fully allocated. Prospective applicants should stay informed about the latest developments in the ADU Grant and Loan Programs to be ready for future opportunities.

The CalHFA-approved ADU Participants, including lenders, non-profits, and local government agencies, have had access to reserve funds for the program since its start on December 11, 2023. For comprehensive details about the program’s objectives, the application process, and the upcoming funding phase, interested homeowners are encouraged to visit the official CalHFA website. Interested homeowners must stay informed about the latest developments in the ADU Grant and Loan Programs.

Phase 2 offers renewed opportunities for Californians to contribute to affordable housing solutions in their communities, with a focus on low-income homeowners and a requirement for a Certificate of Occupancy upon ADU completion. While the recent recipients should be aware of potential tax implications, future applicants should also consider this as part of their planning. Receiving benefits from programs like these can result in an IRS income tax form 1099-G. For more detailed information, please refer to the CalHFA Program Bulletin #2023-12.

In 2023 and moving into 2024, the California ADU Grant and Loan Programs have continued their mission to assist homeowners, particularly those in low-income brackets (with income less than 80% of the Area Median Income), in creating more affordable housing options. While the recent Phase 2 funds have been fully allocated, the programs’ objectives and the need for affordable housing remain as critical as ever.

The California Housing Finance Agency (CalHFA) administers the ADU Grant Program, which has offered up to $40,000 in financial aid for predevelopment costs related to ADU construction. As of the latest update, the funds for the recent phase have been fully allocated, but understanding the scope of this assistance is crucial for future applicants.

In addition to the grant, homeowners can explore various loan programs for financing ADU and JADU projects, including assistance with non-recurring closing costs. These options may continue to evolve, helping to lower the barriers to constructing ADUs and enhancing the capability of homeowners to establish additional housing units.

These include assistance with non-recurring closing costs and helping to lower the barriers to constructing ADUs. These programs collectively enhance the capability of homeowners to establish additional housing units, like ADU conversions, which in turn augment housing availability and present affordable living options for renters.

Marking a significant progression, 2023 saw the introduction of Phase 2 in the ADU Grant Program, backed by an additional $25 million allocation. While this phase’s funds have been fully allocated, it reflects California’s ongoing dedication to expanding the state’s housing supply and addressing the needs of low-income households.

The quick allocation of Phase 2 funds reflects the high demand and California’s ongoing dedication to expanding the state’s housing supply. Future applicants should prepare for these opportunities and be aware of potential tax implications, as they may receive an IRS income tax form 1099-G reflecting the receipt of benefits from the program.

A California Accessory Dwelling Unit (ADU) Grant is a financial assistance program designed to help low-income homeowners (with income less than 80% of the Area Median Income) create more housing units in the state. Eligible homeowners can receive up to $40,000 towards predevelopment and non-recurring closing costs associated with ADU construction1. These costs include site preparation, architectural designs, permits, soil tests, impact fees, property surveys, and energy reports2.

As of the latest update, the funds for the most recent phase have been fully allocated, but understanding the program remains crucial for future opportunities.

ADUs are smaller, independent living spaces on the same property as a primary residence, often equipped with their own kitchen, bathroom, and sleeping area. They are an innovative way to add much-needed housing to California’s limited supply3 and are commonly referred to as granny flats, in-law units, or backyard cottages.

The ADU Grant Program’s main objective is to increase California’s housing supply by covering initial expenses for ADU development. Notably, this grant acts as a reimbursement towards the entire project’s renovation loan and does not require repayment. Recipients should be aware of potential tax implications, as they will receive an IRS income tax form 1099-G reflecting the receipt of benefits from the program.

ADU Grant Program – Phase 1

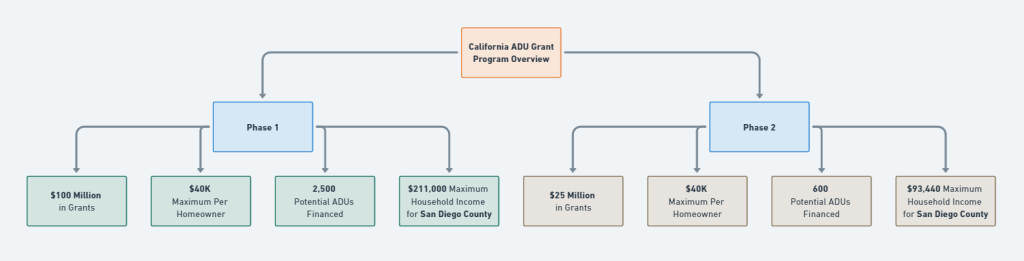

Recap of Phase 1: In 2021, CalHFA was awarded $81 million from the state general fund, with an additional $19 million from its own funds, totaling $100 million for the ADU Program. The program provided $40,000 in grants to low- to moderate-income homeowners for ADU construction.

Source: CalHFA Board of Directors Meeting – 10/26/2023 (California ADU Grant Program – Phase 1 Recap)

Phase 1 Overview:

Geographical Information of Phase 1:

ADU Grant Performance by Region (Phase 1):

ADU Grant Program – Phase 2:

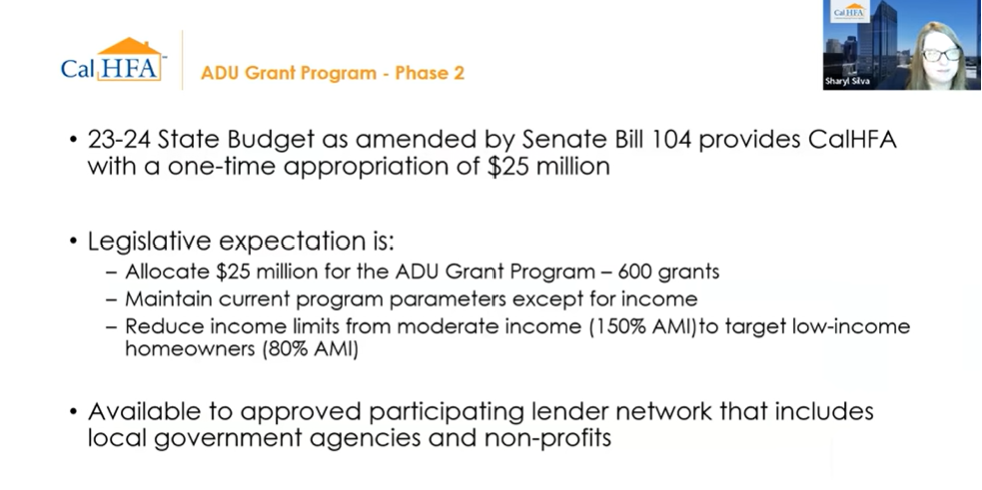

The 23-24 State Budget, amended by Senate Bill 104, provides CalHFA with a one-time appropriation of $25 million for the ADU Grant Program – Phase 24.

While Phase 2 was launched on Monday, December 11, 2023, with a one-time appropriation of $25 million, as of the latest update, these funds have been fully allocated. Interested homeowners should stay informed about any future phases or opportunities.

Source: CalHFA Board of Directors Meeting – 10/26/2023 (California ADU Grant Program – Phase 2)

Phase 2 Overview:

While the potential to finance 600 ADUs under this phase was a significant step, the full allocation of these funds on December 28, 2023, underscores the high demand for such programs. Future applicants should prepare for and stay informed about any new opportunities.

Participating Lender Network:

While the current phase’s funds are fully allocated, maintaining a relationship with approved lenders and staying informed about their offerings can be beneficial for future opportunities.

For a detailed list of participating lenders and financing partner options, please visit the CalHFA ADU Grant Program Participating Lenders and Special Financing Participants supporting document (Last updated on December 28, 2023).

Qualifying for an ADU grant in California requires homeowners to meet certain criteria set by various grant and loan programs, with the CalHFA ADU Grant Program being a primary source of assistance.

To be eligible for the CalHFA ADU Grant Program, homeowners must adhere to specific income requirements, which vary by county. For Phase 2 of the program, the income limit has been adjusted to target low-income homeowners, specifically those with incomes at or below 80% of the Area Median Income (AMI). For San Diego, the income limit is $93,440.

Additionally, the property must be owner-occupied to be eligible for this financial aid. Homeowners are required to complete and sign the CalHFA Participant Affidavit (Rev 11/27/23) and the CalHFA Applicant Affidavit (Rev 11/27/23).

While the recent Phase 2 funds have been fully allocated, understanding these requirements is crucial for homeowners interested in applying for any future allocations or similar programs.

The recent introduction of Phase 2, backed by a $25 million allocation (as per Resolution No. 23-13), emphasizes support for low-income households. This phase aims to provide broader access to funding for ADU construction in socially disadvantaged areas, promoting equity and community stability.

While the funds for Phase 2 have been fully allocated as of the latest update, the focus on supporting low-income households in socially disadvantaged areas highlights the program’s ongoing commitment to these communities. Interested homeowners should stay informed about any future phases or opportunities.

Besides the CalHFA ADU Grant Program, there are other initiatives such as the CalHome Program, San Diego Housing Commission ADU Finance Program, Local Early Action Planning (LEAP) Grants, Local Housing Trust Fund (LHTF) Program, Regional Early Action Planning (REAP) Grants, SB 2 Planning Grants, and Community Development Block Grant Program (CDBG).

Homeowners should research these programs’ requirements as well to determine their eligibility. As program details and availability may change, homeowners are encouraged to regularly check the latest information on these and other related initiatives.

In conclusion, obtaining an ADU grant in California involves meeting specific homeowner and property criteria, strongly focusing on supporting low-income families, particularly under the newly launched Phase 2. Homeowners are encouraged to explore the various available programs to find the best fit for their needs and contribute to creating additional housing units on their property.

To apply for the California ADU Grant Program, prospective applicants should visit the official CalHFA website. The site provides detailed information about eligibility criteria and the application process. The grant offers up to $40,000 towards predevelopment and non-recurring closing costs for constructing an ADU.

As of the latest update, the funds for the most recent phase have been fully allocated. Prospective applicants should continue to visit the official CalHFA website for updates on future funding opportunities and application windows.

Applicants must submit a comprehensive package of documents when applying for the ADU Grant. This includes:

While the recent funds are fully allocated, gathering and preparing these documents in advance will ensure you’re ready to apply promptly when new opportunities arise. Consulting with ADU professionals can provide guidance through the design, permitting, and construction phases.

The timeline for the ADU Grant application can vary based on the number of applications received, specific county regulations, and the extent of predevelopment activities your project requires. It’s advisable to start the application process early to allow sufficient time to obtain necessary building permits and complete other pre-construction tasks like site preparation and architectural planning.

While waiting for new funding opportunities, starting early with preparation and understanding your local regulations will position you well for future application windows.

Phase 2, which began on December 11, 2023, with an additional $25 million allocation, has seen its funds fully allocated. Interested homeowners should regularly check the CalHFA website for updates on future phases or similar programs.

CalHFA will review submitted packages and can contribute a maximum of $40,000 to the construction escrow for building an ADU. These funds are applicable for eligible pre-development costs and non-recurring closing costs. Costs already paid by the applicant won’t be reimbursed as cash but can be used to reduce the principal of the construction loan for the ADU. CalHFA will also issue a Form 1099-G to the borrower in the year they contribute funds to escrow.

While the process described is based on the most recent phase, future applicants should verify if there are any updates or changes in the process for upcoming opportunities.

Working with experienced ADU contractors is crucial for ensuring your project meets program standards. They offer valuable guidance throughout the project, from design and planning to execution, ensuring compliance with all relevant regulations.

In summary, applying for the California ADU Grant involves a thorough preparation of documents and understanding the updated guidelines, especially for the upcoming Phase 2. Staying informed and seeking professional advice will be key to successfully navigating this opportunity.

The California ADU Grant Program offers significant financial support for homeowners aiming to build an Accessory Dwelling Unit (ADU). Eligible homeowners can receive up to $40,000 in reimbursements for predevelopment and non-recurring closing costs associated with ADU construction. This assistance helps cover expenses such as site preparation, architectural designs, permits, soil tests, impact fees, property surveys, and energy reports, making ADU construction more accessible and affordable for many Californians.

While the funds for the most recent phase have been fully allocated, the financial support provided by the program, when available, can significantly ease the burden of ADU construction costs for many Californians.

A well-designed and strategically constructed ADU can significantly increase the value of a property. By adding a separate living space with amenities such as a bedroom, bathroom, and kitchen area, homeowners can potentially attract a higher price when it’s time to sell their property. Having a professionally designed ADU, preferably by a knowledgeable architect, can improve the property’s aesthetics and ensure compliance with local regulations, further enhancing the property’s value.

ADUs are a practical solution to California’s housing affordability crisis. They offer an economical alternative to traditional housing developments as they don’t entail the high costs of land acquisition and major infrastructure upgrades. For homeowners, ADUs can serve as a source of rental income, while for communities, they provide much-needed affordable rental options. Participation in the ADU Grant Program is mutually beneficial, aiding homeowners financially while contributing to the broader goal of increasing affordable housing availability.

The ADU Grant Program’s contribution to affordable housing remains vital, and interested homeowners should stay alert for future funding opportunities to be part of this solution.

While the additional $25 million allocation for Phase 2 has been fully utilized, the focus on aiding low-income homeowners continues to highlight the program’s commitment to providing affordable housing options. Homeowners interested in future phases should stay informed and prepared.

By encouraging the development of ADUs, the California ADU Grant Program plays a pivotal role in addressing housing challenges while also offering homeowners a viable option for property enhancement and income generation. The program’s expansion with Phase 2 underscores the state’s ongoing commitment to tackling its housing crisis innovatively and inclusively.

The program’s impact on community and economic development is ongoing. As the state continues to address its housing crisis, staying informed about future phases of the ADU Grant Program and other similar initiatives will be crucial for homeowners looking to contribute to and benefit from these efforts.

Navigating zoning laws remains a significant challenge in implementing the California ADU Grant and Loan Programs. Local authorities often have stringent zoning codes that can restrict the construction of new ADUs or impose specific design limitations. These restrictions can hinder homeowners’ ability to fully utilize these programs to create affordable housing solutions.

Despite the California Department of Housing and Community Development’s initiatives to persuade local governments to ease ADU zoning laws, many municipalities remain reluctant. This hesitancy leads to lengthy, sometimes costly, approval processes for homeowners wishing to build ADUs.

Homeowners are encouraged to seek guidance from local planning departments or professional ADU consultants who can provide up-to-date information on zoning regulations and assist in navigating the approval process.

The financial burden of constructing an ADU is another challenge. While the grant and loan programs cover certain costs like predevelopment and non-recurring closing expenses, the total cost of construction can be substantial, influenced by factors such as material costs, labor rates, and permitting fees. Under the new Phase 2 of the program, the focus on aiding low-income households (80% AMI) may exclude homeowners above this income threshold but still in need of financial support for ADU construction.

For instance, the maximum household income for San Diego County is $93,440 per year. This income threshold varies by county, which may exclude some homeowners who need financial assistance to create affordable housing solutions through ADUs.

With the recent funds fully allocated, homeowners should also explore other financing options and budget carefully for the total cost of construction, keeping in mind the fluctuating prices of materials and labor.

The introduction of Phase 2 brings updated program guidelines with a renewed focus on supporting lower-income households. This shift may change the demographic of applicants eligible for the program. Homeowners interested in the program must stay updated on these evolving requirements to ensure they meet the new eligibility criteria.

As program guidelines continue to evolve, staying informed and prepared will be key for homeowners looking to participate in future phases or similar programs.

Prospective participants need to consider the regulatory and financial challenges when planning their ADU projects. While the ADU Grant and Loan Programs aim to promote affordable housing, the realities of dealing with zoning laws and managing construction costs can be overwhelming. Homeowners should carefully assess these challenges against the potential benefits of building an ADU.

Despite these challenges, the long-term benefits of adding an ADU can outweigh the initial hurdles. Seeking advice from financial advisors and ADU experts can provide valuable insights and help homeowners make informed decisions.

The California ADU Grant Program offers significant financial support to homeowners for constructing Accessory Dwelling Units (ADUs), focusing particularly on the crucial predevelopment phase. These costs represent the initial expenses incurred before actual construction begins and are vital for ensuring a successful and compliant ADU project.

While the funds for the most recent phase have been fully allocated, understanding these predevelopment costs is crucial for homeowners interested in applying for any future allocations or similar programs.

While the additional $25 million allocation for Phase 2 has been fully utilized, the focus on aiding low-income homeowners continues to highlight the program’s commitment to providing affordable housing options. Homeowners interested in future phases should stay informed and prepared.

For homeowners contemplating an ADU project, comprehending these predevelopment costs is essential. Consulting with experienced ADU professionals and staying updated on the latest program guidelines is advisable for successfully navigating the application process. This proactive approach can effectively leverage the grant program to create additional, affordable housing options on their properties.

As program guidelines and funding opportunities continue to evolve, staying informed and prepared will be key for homeowners looking to participate in future phases or similar programs. This proactive approach can effectively leverage future grant programs to create additional, affordable housing options on their properties.

Understanding the Repayment Terms of the California ADU Grant Program

The California ADU Grant Program plays a pivotal role in helping homeowners build accessory dwelling units (ADUs) on their properties. A key feature of this program is the nature of the funding: it provides grants, not loans, which significantly eases the financial burden on recipients as these funds do not require repayment.

While the funds for Phase 2 have been fully allocated, the program’s continued focus on assisting low-income households highlights the importance of staying informed about future phases or similar initiatives.

The ADU Grant Program, especially with its updated focus and increased funding, represents a significant effort by the state of California to expand affordable housing options2. By removing the requirement for repayment, the program lessens financial barriers for homeowners, encouraging the construction of ADUs. This not only aids in alleviating the housing crisis but also promotes community stability and increases housing diversity.

For homeowners considering building an ADU, understanding the grant’s no-repayable nature can be a key deciding factor. It offers a practical solution to expand living space, generate rental income, or accommodate family members, contributing positively to both individual households and the broader community.

Recognizing that the grant does not require repayment can significantly alleviate financial concerns for homeowners, making the prospect of building an ADU more attainable and appealing.

Yes, homeowners who already have funds for their ADU project can still receive a grant without refinancing or applying for a construction loan. The California Housing Finance Agency (CalHFA) offers a $40,000 grant to help low-income homeowners cover pre-construction costs associated with building an Accessory Dwelling Unit (ADU).

Navigating the ADU Grant Program with Existing Funds

A significant advantage of the California ADU Grant Program is its flexibility, particularly for homeowners who already possess funds for their ADU project. The California Housing Finance Agency (CalHFA) extends a $40,000 grant to facilitate the construction of Accessory Dwelling Units (ADUs), even for those who don’t need additional financing through loans.

While the funds for the most recent phase have been fully allocated, understanding how the grant can complement existing funds is crucial for homeowners interested in applying for any future allocations or similar programs.

Key Aspects of the Grant:

Applying for the Grant:

Homeowners should regularly check the official CalHFA website or consult with organizations like CCEDA for the most up-to-date information on eligibility and the application process.

Eligibility and Compliance:

As the program continues to evolve, staying informed about the latest guidelines and funding opportunities will be key for homeowners looking to participate in future phases or similar programs.

Strategic Benefits:

Phase 2 Considerations:

Current Status of the California ADU Grant Program

The California Accessory Dwelling Unit (ADU) Grant Program has seen significant updates and developments in 2023. Here’s what you need to know about its current availability:

Previous Funding and Program Pause:

Additional Funding and Phase 2 Launch:

Phase 2 Details and Expectations:

As the landscape of the ADU Grant Program continues to evolve, staying up-to-date with the latest information and preparing your application materials in advance will be crucial for participation in any future phases.

Strategic Focus of Phase 2:

Despite reaching its funding capacity in the initial phase, the launch of Phase 2 signifies California’s ongoing efforts to support affordable housing. Homeowners considering ADU development are encouraged to stay informed and prepare for future opportunities to participate in this valuable program.

Exploring Financing Options for ADU Construction in California

California’s commitment to expanding affordable housing options extends beyond the ADU Grant Program. Homeowners looking to build Accessory Dwelling Units (ADUs) have access to a variety of financing sources, accommodating different financial circumstances and project needs.

Diverse Loan Opportunities:

Before opting for any loan, it’s advisable to consult with a financial advisor to understand the implications fully and choose the option that best suits your financial situation and project needs.

State and Local Programs:

As program details and availability may change, regularly checking the HCD website and local government resources for the latest information is recommended.

Recent Developments:

California homeowners considering ADU construction have multiple financing routes to explore. From leveraging home equity to taking advantage of state and local programs, these options cater to different financial situations and ADU project scales. Staying informed about the latest developments in state funding and loan programs is crucial in making the most out of these opportunities.

CalHFA Loan Programs and Their Relevance to ADU Financing

The California Housing Finance Agency (CalHFA) offers a suite of loan programs aimed at assisting low-to-moderate-income families in achieving homeownership, which can also be relevant for those considering ADU projects.

Core Loan Programs:

Homeowners interested in these programs should consult the official CalHFA website for the most up-to-date information on eligibility, terms, and application procedures.

ADU-Specific Considerations:

When considering these loan programs for ADU projects, it’s advisable to consult with a financial advisor or a loan officer who can provide guidance on how to effectively integrate these funds into your ADU development plan.

CalHFA’s loan programs offer valuable opportunities for low-to-moderate-income families in California, not just for home purchasing but also as potential stepping stones for ADU projects. By understanding the interaction between these loan programs and ADU financing, homeowners can better navigate their options and plan effectively for their ADU development.

Distinguishing CalHFA and FHA in the Context of ADU Financing

The Federal Housing Administration (FHA) and the California Housing Finance Agency (CalHFA) both play pivotal roles in facilitating affordable housing. Yet, they serve distinct functions that are particularly relevant to those considering ADU projects.

FHA’s Role: FHA, a federal entity, primarily provides mortgage insurance, backing loans made by approved lenders. This support is crucial for first-time homebuyers and low-to-moderate-income borrowers, offering more lenient credit and down payment terms. FHA-insured loans can be used for purchasing homes that might include ADUs or for refinancing purposes that could free up funds for ADU construction.

Homeowners interested in FHA-insured loans should consult with approved FHA lenders to understand the specific terms, benefits, and suitability of their ADU projects.

CalHFA’s Specialized Focus: CalHFA caters specifically to California’s unique housing needs. It offers mortgage assistance and direct grant programs for ADU construction.

While the recent $25 million allocation for CalHFA’s ADU grant program has been fully utilized, the agency’s ongoing commitment to California’s housing needs suggests potential future opportunities. Interested homeowners should stay alert for any announcements regarding additional funding or programs.

Impact on ADU Projects:

Prospective ADU builders should consider how FHA loans and CalHFA grants might complement each other, potentially combining resources from both to create a more comprehensive and effective financing strategy for their ADU projects.

Understanding the differences between CalHFA and FHA is crucial for Californians exploring options for ADU projects. While FHA provides a broader, nationwide support system for affordable home purchasing, CalHFA offers more targeted assistance for ADU construction within California. Prospective ADU builders should consider both options to maximize their resources and opportunities for successfully completing their ADU projects.

Updated Income Limits for the California ADU Grant Program

The income limits for the California ADU Grant Program play a crucial role in determining eligibility for homeowners in San Diego and across the state. These limits vary by location and household size, focusing on supporting low-income families. Here’s what San Diego homeowners need to know:

CalHFA ADU Grant Program: Managed by the California Housing Finance Agency (CalHFA), this program offers up to $40,000 towards predevelopment and non-recurring closing costs for the construction of ADUs. Eligible expenses under this grant include site preparation, architectural designs, permits, soil tests, impact fees, property surveys, and energy reports.

While the recent allocation for the CalHFA ADU Grant Program has been fully utilized, understanding the income limits is crucial for homeowners interested in applying for any future allocations or similar programs.

Income Eligibility Based on AMI: Eligibility for the grant is now targeted towards low-income homeowners, specifically those earning up to 80% of the Area Median Income (AMI) as set by HUD. This recent adjustment is designed to help households most in need of affordable housing solutions.

As AMI figures are subject to annual adjustments, homeowners should verify the most current income limits through official resources like the HUD User website or CalHFA.

San Diego Specifics: In San Diego County, for the year 2023, the maximum income limit for a household of four to qualify as low income (less than 80% AMI) is approximately $93,440. This figure provides a guideline for San Diego residents to assess their eligibility for the grant program.

For the most accurate and current income limits applicable to your county, consult your local housing authority or the CalHFA website.

County-Wide Variations: It’s important to note that income limits differ from county to county. Homeowners should refer to the 2023 Low-Income Limits (<80% AMI) for the CalHFA ADU Grant Program for a clear understanding of their specific county’s limits. For instance, in Los Angeles County, the maximum income limit is $84,160, while in San Francisco, it is $126,560.

Utilizing HUD User Website: For an in-depth view of AMI guidelines across various regions, the HUD User website remains a valuable resource. This site offers detailed information to help applicants determine their qualification status based on their location and household size.

Understanding and adhering to the income limits is a critical step in applying for the California ADU Grant Program. Homeowners interested in constructing ADUs should utilize the provided resources to assess their eligibility and take the first step toward building a cost-effective and valuable addition to their property.

Credit Score Requirements for CalHFA Loans and ADU Financing

Understanding the credit score requirements for CalHFA loans is crucial for first-time homebuyers and those considering building an ADU in California, including San Diego. Here are the key points:

ADU Grant Program – Updated Information as of October 2023

The California Housing Finance Agency’s (CalHFA) ADU Grant Program continues to support homeowners by providing up to $40,000 towards predevelopment and non-recurring closing costs in the construction of Accessory Dwelling Units (ADUs). These costs encompass a range of pre-construction necessities, including site preparation, architectural designs, permits, soil tests, impact fees, property surveys, and energy reports. It’s important to note that the grant amount may vary depending on the homeowner’s specific needs and project details.

Homeowners interested in the grant should consult with CalHFA or an approved lender to understand the specific grant amount they may be eligible for based on their project details and needs.

Program Updates (As of October 26, 2023): The CalHFA Board of Directors recently approved the details for the second round of ADU Grant funding. A key update in this phase is the adjustment of applicant income limits to 80% of the Area Median Income, focusing the program on assisting low-income homeowners. The full list of Approved Participants (Last updated on November 20) is available, and the program opened for new reservations on December 11, 2023, following an official announcement in mid-November.

As program details and availability may change, regularly checking the CalHFA website for the most up-to-date information is recommended.

About ADUs: ADUs, commonly known as granny flats, in-law units, backyard cottages, or secondary units, offer a practical and affordable solution to California’s housing shortage. They serve as independent living spaces on the same property as a primary residence, often complete with essential amenities.

For the latest updates on the ADU Grant Program, including lender information and application guidelines, please visit the CalHFA ADU page.

The California Housing Finance Agency (CalHFA) offers various loan programs to assist homebuyers in achieving their dream of homeownership. One such program is the CalHFA Conventional Program, which provides a fixed interest rate for a 30-year term.

Interest Rate Variability: Interest rates for CalHFA loan programs can vary depending on the specific program and market conditions. For example, the CalPLUS Conventional program includes a 3% Zero Interest Program (ZIP) for eligible homebuyers, offering a deferred payment loan with a 0% interest rate for a portion of their down payment or closing costs. For personalized rate information based on your specific circumstances, it’s advisable to consult with a CalHFA-approved lender who can provide detailed guidance.

CalHFA FHA Loan Program: The CalHFA FHA loan program, an FHA-insured first mortgage, offers a slightly higher 30-year fixed interest rate than the standard FHA program. It is combined with the CalHFA Zero Interest Program (ZIP) for closing costs, providing valuable financial assistance to eligible homebuyers.

Regular Rate Updates: It is important to note that interest rates for CalHFA loan programs may change periodically. Potential borrowers should consult the CalHFA Rates page for the most up-to-date interest rate information.

Factors Influencing Rates: Individual interest rates may also be influenced by factors such as your credit score and debt-to-income ratio. These factors can significantly impact the rate offered, and potential borrowers should consider them when applying for a loan.

Understanding how your credit score, debt-to-income ratio, and other financial factors influence your offered interest rate is crucial. A financial advisor or loan officer can provide insights into optimizing your financial profile for the best possible rate.

Summary: The CalHFA loan program offers various fixed-rate mortgage options to assist homebuyers in California. Interest rates may vary depending on the specific program and individual financial situation. The CalHFA Conventional program, CalPLUS Conventional program, and CalHFA FHA loan program are some examples, each with its own interest rates and financial assistance options.

Yes, a buyer can combine a CalHFA loan with a 203k program. The 203k program is a special FHA loan that allows homebuyers to finance both the purchase of a home and the cost of its rehabilitation through a single mortgage.

CalHFA and 203k Integration: CalHFA recently added the option to use a limited 203k as part of their offerings. This allows buyers to roll the costs of minor remodeling and non-structural repairs into their mortgage payment, with up to $35,000 available for eligible repairs.

To ensure a smooth integration of a CalHFA loan with the limited 203k program, it’s crucial to consult with CalHFA-approved lenders who are experienced in handling both loan types.

Focus of the Limited 203k Program: The limited 203k program focuses on minor renovations that do not involve major structural changes or additions to the property. Examples of eligible improvements include:

The scope of eligible improvements under the limited 203k program may vary. Consulting with a 203k consultant will provide a comprehensive assessment and ensure that your planned renovations comply with the program’s guidelines.

Working with Loan Officers and 203k Consultants: It is crucial for buyers to work with a knowledgeable loan officer to determine their eligibility for a CalHFA loan and understand the specific requirements of the limited 203k program. Loan officers can also help buyers pre-qualify for a loan amount, providing an estimate of how much they can afford. Additionally, a 203k consultant is essential in assessing the scope of work and ensuring that the renovations comply with the guidelines of the limited 203k program.

Seeking loan officers and 203k consultants with experience in both CalHFA loans and 203k programs can provide you with the best guidance and help streamline the financing process.

Combining Financing Options: By combining a CalHFA loan with a 203k program, buyers can access financing options that cater to their unique needs, making homeownership and necessary home improvements a more attainable goal.

For individuals looking to finance an Accessory Dwelling Unit (ADU) in California through a CalHFA FHA Loan, understanding the role of co-borrowers and co-signers is crucial. Co-borrowers are equally responsible for the loan and hold ownership of the property, while co-signers guarantee the loan but do not have property ownership.

CalHFA’s Policy on Co-borrowers and Co-signers: According to the latest CalHFA guidelines, the agency has specific restrictions regarding the use of non-occupant co-borrowers and co-signers in their loan programs, including FHA Loans. This policy is designed to maintain the focus of their programs on assisting low- to moderate-income borrowers.

As policies may change, it’s important to review the most current CalHFA guidelines or consult with a CalHFA-approved lender to understand the latest on co-borrower and co-signer eligibility.

Understanding Funding Laws and Regulations: Potential borrowers must be aware of the funding laws and regulations in California, which include income and loan limits, as well as specific eligibility criteria. These regulations ensure that financial assistance is directed toward those most in need.

Understanding how funding laws and regulations apply to your specific situation, especially when considering a co-borrower or co-signer, is crucial for ensuring compliance and eligibility.

Exploring Alternative Financing Options: For those who may not meet these requirements, alternative financing options are available. Exploring other loan programs or complying with CalHFA’s specific eligibility criteria, like meeting the minimum credit score and debt-to-income ratio, can be viable paths to financing ADU projects.

Consider a wide range of financing options, including other state or local programs, to find the best fit for your financial situation and homeownership goals.

Seeking Professional Guidance: If you’re considering financing an ADU project, consulting with a knowledgeable mortgage professional is highly recommended. They can provide valuable insight into various financing options and help identify the best approach for your situation, ensuring compliance with funding laws and aiding in achieving your homeownership and property development goals.

Yes, it is possible to refinance an existing CalHFA loan. Refinancing an existing CalHFA loan is a practical option for homeowners in California seeking financial flexibility. The California Housing Finance Agency (CalHFA) provides various refinancing solutions, which may lead to benefits such as reduced interest rates, lower monthly mortgage payments, or adjusted loan terms to align with the homeowner’s current financial needs.

Key Considerations for Refinancing with CalHFA:

For California homeowners with a CalHFA loan who are contemplating refinancing, it is crucial to thoroughly explore and understand the available options and their respective eligibility criteria. While CalHFA presents a variety of programs tailored to diverse needs, careful consideration of the specific details and restrictions of each program is essential for making well-informed refinancing decisions.

San Diego’s ADU (Accessory Dwelling Unit) Bonus Program is a strategic initiative aimed at bolstering the city’s affordable housing supply. This program incentivizes homeowners to construct ADUs on their properties, offering added benefits for those who agree to deed restrict their ADUs as affordable for very low-, low-, or moderate-income households for a 15-year duration.

Key Features of the ADU Bonus Program:

These incentives not only benefit homeowners but also contribute to the broader community by increasing the availability of affordable housing options in San Diego.

Further Resources and Information:

For more detailed information, the City of San Diego’s Planning Department and SDHC offer comprehensive resources. Homeowners can find guidelines on ADUs and JADUs, including the Companion Unit Handbook and Information Bulletin 400. Additionally, standard and permit-ready ADU building plans accepted by the City of San Diego are available, easing the construction process.

Consulting these resources early in your planning process can provide valuable insights into requirements and available support and streamline your journey to building an ADU.

Conclusion

San Diego’s ADU Bonus Program is a significant step towards creating more affordable housing options in the city. By incentivizing homeowners to build ADUs and providing necessary support and resources, San Diego is addressing housing affordability and promoting sustainable urban development efficiently.

For individuals interested in California’s ADU Grant and Loan Programs, staying updated with the latest information from the California Housing Finance Agency (CalHFA) is crucial. Here are some effective ways to keep abreast of CalHFA’s offerings and updates:

In summary, by leveraging these various channels, you can stay well-informed about the evolving landscape of housing finance options in California. Whether you’re considering applying for an ADU grant or looking for financing options for your housing project, staying updated with CalHFA’s latest news and programs will help you make informed decisions for your housing needs.

Many homeowners in California have benefited from the ADU Grant Program, turning their properties into comfortable, inviting spaces for their families and guests. One such story involves a family in Poway who enlisted the help of ADU Contractors to design and build their dream accessory dwelling unit.

Another example is a homeowner in La Jolla who partnered with a La Jolla ADU Contractor to create a smaller home on their property. This not only added value to their land but also allowed them to make the most of available space. Their ADU journey was smooth, thanks to the expert guidance and craftsmanship provided by the builder.

In Encinitas, a fortunate homeowner collaborated with an Expert ADU Contractor to construct an additional unit to their home. This new space improved their overall living experience and increased the property’s appeal.

Carmel Valley is no stranger to success stories, as residents there have also taken advantage of the ADU Grant Program. One example showcases a homeowner who worked closely with ADU Contractors in Carmel Valley to bring their ADU vision to life. The resulting structure added both function and beauty to their property.

These success stories demonstrate the potential of the ADU Grant Program to transform properties across California. Leveraging experienced ADU Design and Builder Contractors can make the journey toward building an accessory dwelling unit a positive and rewarding experience for homeowners.

In recent years, the State of California has significantly expanded its efforts to facilitate the construction of Accessory Dwelling Units (ADUs), making them more accessible and financially viable for homeowners. The evolving landscape of these initiatives, especially through the CalHFA ADU Grant Program, has been instrumental in addressing the state’s housing affordability and availability issues.

Key Highlights:

In Summary, California’s ADU programs, comprising grants and loans, are strategically crafted to ease housing shortages and foster responsible property development. Homeowners are encouraged to leverage these opportunities to enhance their property values and contribute to a more sustainable living environment across the state.

By staying informed and working with experienced professionals, homeowners can navigate these programs effectively and transform their property to meet their needs and those of the broader community. As California’s ADU programs continue to evolve, staying updated on program changes and new opportunities will be key to making the most of these initiatives.

Yes, constructing an Accessory Dwelling Unit (ADU) on your property may lead to an increase in property taxes. This is because the construction of an ADU often results in an increase in the property’s value, and property taxes are typically based on the assessed value of the property. For a precise assessment, consider consulting your local assessor’s office or a property tax advisor.

The exact amount by which an ADU may increase property taxes depends on the value added by the ADU and the local property tax rate. Each jurisdiction in California has its own tax rate, so the increase may vary based on your location. The increase in property taxes can be calculated by multiplying the increased assessed value by the local property tax rate. For a more accurate estimate tailored to your property, you might want to contact a local tax assessor or a real estate professional.

The California ADU Grant Program can provide up to $40,000 in assistance for predevelopment and non-reoccurring closing costs associated with the construction of an ADU. These costs may include items such as site preparation, architectural designs, permits, soil tests, impact fees, property surveys, and energy reports.

Information on the CalHFA ADU Grant application process and forms can be found on the CalHFA website. Homeowners interested in the program should visit the website for complete details and instructions on how to apply.

Yes, there are lenders that participate in the CalHFA ADU Grant program. To find a participating lender, you can refer to the list of approved lenders provided on the CalHFA website.

As of the time of writing, it is unclear if the California ADU amnesty program is still available. The program aimed to help homeowners legalize unpermitted ADUs by providing assistance with the permitting process. It is recommended to check with your local jurisdiction or a housing expert for the most current information on this program.

A first-time homebuyer is generally defined as someone who has not owned a home in the previous three years. However, specific definitions and eligibility requirements may vary depending on the program or financial assistance. It is best to consult with the specific program or lender for their eligibility criteria.

If you’re considering building an Accessory Dwelling Unit (ADU) and navigating the complexities of grants and loans in California, don’t hesitate to contact us at Kaminskiy Design and Remodeling.

Our team of experts is ready to guide you through every step of the process, ensuring you make the most of the available programs. We’re committed to turning your vision into reality while maximizing your investment.

Give us a call at (858) 271-1005, or to schedule a consultation, simply fill out our contact form. We look forward to partnering with you on your ADU project!

Last updated on January 2, 2024

Kimberly Villa is a recognized expert in the Home Design and Remodeling industry. Her passion for the industry is matched only by her love for sharing insights, new trends, and design ideas. Kimberly’s expertise and enthusiasm shine through in her contributions to the Kaminskiy Design and Remodeling website blog, where she regularly shares valuable information with readers.